The primary purpose of Association Health Plans (AHPs) may be to offer health coverage, but the association must also have at least one substantial business purpose unrelated to providing benefits. Nondiscrimination rules generally prohibit different rating or eligibility rules for each employer. “Worker owners”, such as sole proprietors, can participate if certain requirements are met, and AHPs offer generally relaxed commonality of interest rules, which allows for geographically based AHPs.

The final rule, passed in June (2019), makes it easier for otherwise unrelated employers to group together to form a single large group health plan, thus avoiding certain ACA rules applicable to small-group insured plans. Barriers still exist in some states to forming AHPs under the new rules, and a federal district court has held the final rule invalid, placing the future of AHP expansion in doubt.

You can learn more about Association Health Plans and see up-to-date regulations on the DOL website.

This recent regulation extends short-term, limited-duration insurance (STLDI) plans to have a total coverage period (including any insurer approved renewals) of up to 36 months. Formerly, STLDI insurance was limited to just 3 months because they are not subject to ACA requirements and cover significantly less than the ACA compliant coverage.

STLDIs are considered a type of primary medical coverage. They are intended for individuals who have a temporary gap in coverage—people who might be between jobs or between school and a job. STLDIs are not subject to ACA requirements, are not available in the individual market, and generally do not cover pre-existing conditions.

STLDIs can be a good thing—they fill a clear gap. However, now that they have been expanded to a 12-month policy (renewable up to 36 months), it’s an alternative to an ACA compliant plan. These plans will likely have consumer complaints due to the lack of coverage, and many states are not allowing them for this exact reason.

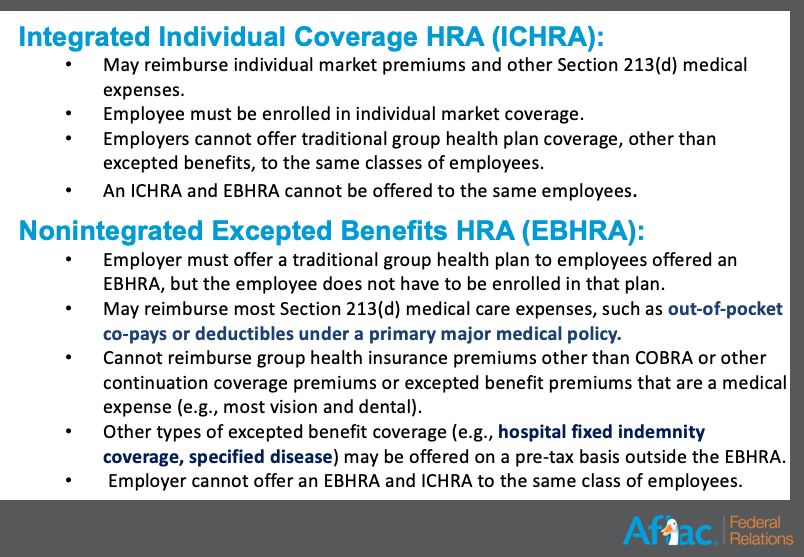

The tri-agencies released final rules in June 2019 to expand Health Reimbursement Accounts (HRAs). The final rules could significantly change the health benefits landscape by establishing two new HRAs. While employers of any size can adopt the HRAs, they may be of particular interest to small employers that don’t currently offer coverage.

President Trump issued an executive order on June 24, 2019 for greater health care cost transparency. The administration is looking at using agencies such as the Justice Department to tackle regional monopolies of hospitals and health insurance plans over concerns that they are driving up the cost of care. It will spark new regulations and guidance in a variety of areas, including Health Savings Accounts.

On June 26, 2019, the Senate HELP Committee approved its bipartisan package aimed at lowering costs for patients by addressing surprise medical bills and price transparency. The idea is that people don’t really have a chance to shop around for health care—they don’t really know what treatment is going to cost them. This new order should create an environment of more competition and smarter health care consumerism.

On the other end of the spectrum, Big Pharma does not like this move. And, other entities are finding clever ways of sidestepping the regulations, like confusing and complicated price coding. The Department Of Justice will likely step in to address this; they want people to be more educated on the health care shopping and billing process. For example, not all of the doctors in a hospital have to be a part of a ‘network’, which can lead to major cost increases and surprise bills. The new plan would limit exposure to only ‘in-network’ rates, which is hard to regulate and will likely be legally challenged.

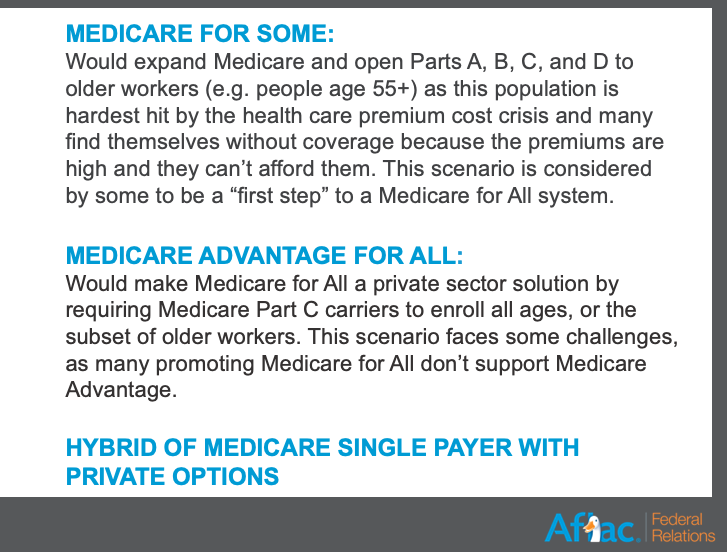

Some stakeholders have a problem with Medicare for All, because they say we can’t afford Medicare as it is today. The way the current funding structure is set up, the Medicare trust fund is projected to be insolvent three years sooner than expected. There are a lot of details that are left to be discussed about how such a system disruption would work. There are a variety of other conversations on other models, so only time will tell how these issues are addressed.

To address this pressing issue, Republican plans to rely on tax incentives or drawing down from social security or privatized plans. Democrats, on the other hand, are talking about a requirement/mandate and a national system (aka taxes).

It’s an important tool economically and something that resonates politically, so expect to see a continued emphasis on this topic and more changes at a state and local level.